A Supersized IRS: More Audits, Investigations and Tax Enforcement for Americans

IRS FUNDING

The Democrats’ latest version of their social spending spree includes $80 billion of new funding for the Internal Revenue Service (IRS). This near-doubling of the agency’s budget will inevitably lead to increased audits and investigations of every American taxpayer. No one knows exactly how the IRS will spend the money on new audits and investigations, since the bill gives the $80 billion to the IRS first, and then asks for spending plans to be provided later--that is, fund now, plan later.

There is a long list of reasons the IRS should not be given this massive funding boost, from its history of leaks, data security failures and political discrimination, to its heavy-handedness with taxpayers. Click HERE to learn more about concerns with the IRS funding proposal. This proposal raises a number of serious concerns, paramount being privacy. It also sparks concerns with data security, as the IRS has a history of leaks, hacks and other violations of taxpayer confidentiality. Low- and middle-income earners would certainly be swept into this dragnet.

IRS FINANCIAL INSTITUTION REPORTING DRAGNET

There is also a proposal to create a reporting scheme where financial intermediaries report to the Internal Revenue Service (IRS) on customer “inflows and outflows.” Under this dragnet, local banks, credit unions and payment providers will essentially be turned into agents of the IRS, monitoring and reporting on inflows and outflows of deposits and withdrawals made in private accounts.

In October 2021, I held an event in Idaho with other concerned leaders and constituents on a related proposal that would have required financial institutions to report to the IRS on their customers’ deposits and withdrawals. Thanks to an outcry of strong opposition, it was left out of the House’s version of “Build Back Better.” However, there is still--hidden in the $80 billion funding boost--a provision to provide $145 million for the IRS to hire regulation writers who could find ways to write similar rules from the IRS.

Making sure tax cheats pay the taxes they owe is important, but law-abiding Americans’ privacy must not be trampled to accomplish that goal. The IRS does not need to have access to the accounts of every American. It cannot be trusted with this information, and I will continue to fight enabling this broadened authority.

READ MORE ABOUT THESE ISSUES

- Post Register: The IRS needs reform, not more power

- Daily Signal: IRS Is Overstepping Its Boundaries with Lazy and Destructive Proposal

- ABC News: Biden admin backs down on tracking bank accounts with over $600 annual transactions

- Market Watch: Biden revises proposal to have IRS monitor bank accounts more closely. Here’s how it would work

- Washington Examiner: ‘Not good enough’: Democrats scale back $600 IRS disclosure after backlash

- Wall Street Journal: The $10,000 IRS Tax Dragnet

LEARN MORE ABOUT SENATOR CRAPO's EFFORTS

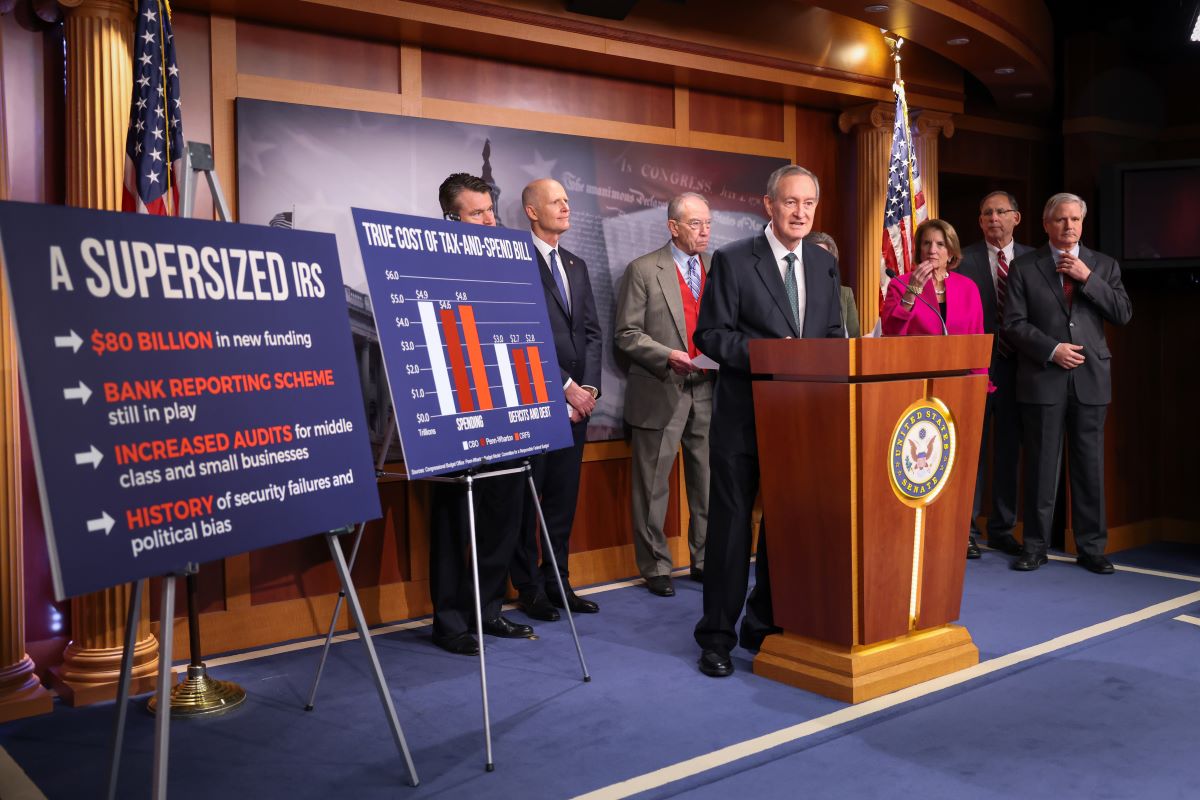

- Led a news conference with Republican senators to highlight concerns with proposals to double funding for the IRS.

- Sent a letter to U.S. Treasury Secretary Yellen asking for details of the bank reporting proposal.

- Led an October 12 roundtable discussion with concerned Idahoans to discuss the reporting scheme.

- Delivered remarks on the Floor of the U.S. Senate calling on Americans to loudly reject the intrusive IRS reporting regime.

- Led a press conference with other Republican members of the Senate Banking and Senate Finance Committees to blast the IRS bank reporting dragnet.

- Introduced legislation with Senator Tim Scott to block Democrats’ IRS financial reporting proposal.

- Introduced the Tax Gap Reform and IRS Enforcement Act to add significant guardrails around IRS funding to protect taxpayer rights and privacy.