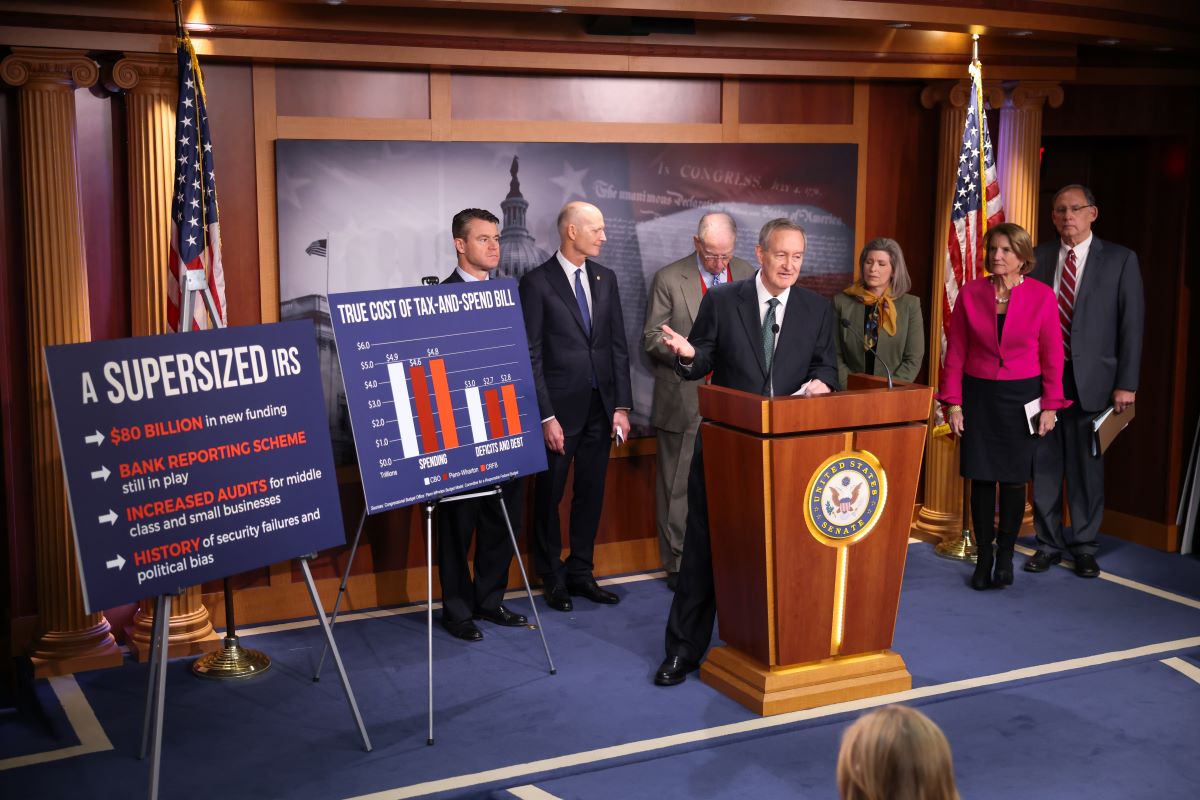

A Supersized IRS: More Audits, Investigations and Tax Enforcement for Americans

Senate Republicans highlight catalog of concerns with $80 billion funding boost

Washington, D.C.--U.S. Senator Mike Crapo (R-Idaho), the top Republican of the Senate Finance Committee, led a news conference with Republican Senators on Democrats’ plans to nearly double the budget of the Internal Revenue Service (IRS), which will lead to increased audits and investigations of every American taxpayer.

Highlights from the news conference:

Senator Mike Crapo (R-Idaho), on increased audits for the middle class:

“The IRS cannot generate the money that the Democrats claim they will from this funding, unless it focuses the target right on the middle class. That’s what the data show, and what they don’t want to say. This supersized IRS will create an army of auditors to come out and go after the tax gap, which lies primarily in income categories under $400,000.”

Senator Chuck Grassley (R-Iowa), on the IRS targeting small businesses:

“A lot of those people under $400,000 are small businesses. In 2021, we’ve seen the auditing of small business go up 50 percent. . . We still have to be very fearful of the additional money going to the IRS harassing small business more than going after the money of the people over $400,000 per year. . . In America, we have a choice between life, liberty and the pursuit of happiness. Or you’ve got the choice of letting bureaucrats run your life. The IRS is the most feared agency . . . to do business with.”

Senator Todd Young (R-Indiana), on Americans’ distrust in the IRS:

“The American people deserve to know: The Democrats propose spending eighty billion in their tax, borrow, spend, and regulate Build Back Better Plan. Eighty billion dollars towards the IRS. . . . Even worse, we have been told by the President of the United States--he campaigned on a platform of ensuring taxes would not be increased. . . . We know that most of this $80 billion will be used to enhance the ability of the IRS to target middle Americans. That promise will be broken. Yet another. Nearly six months since ProPublica leaked private, legally protected taxpayer information, at a time when there is a peak level of distrust of the Internal Revenue Service, Democrats want to increase the power of the IRS to insinuate themselves into the private lives of ordinary Americans.”

Senator Rick Scott (R-Florida), on targeting families and existing IRS leaks:

“This additional money for the IRS to target all Americans is absolutely wrong. It will target our families, it’s going to target our small businesses, and it’s going to go after them to get them to pay more money. The IRS can’t keep information confidential; there’s breaches and they’ve released information to ProPublica. On top of that, when you ask for your refund, you have to give them a selfie so they can track you. Our IRS is acting like Big Brother.”

Senator Shelley Moore Capito (R-West Virginia), on the increased burden on small business:

“When you look at small businesses, we have 113,000 small businesses in West Virginia that would be impacted by this. . . . The invasion of privacy into individuals and small businesses is something that we hear about every day, and I think would devastate our economies. And think of the cost that this is going to be to small businesses. Not only just being audited, but the time and energy and money it takes to answer. . . . When you saw the average amount of recouped tax in some of the smaller businesses in some of the lower incomes, it's $20, $25. It's going to cost them thousands of dollars to be able to answer this.”

Senator John Boozman (R-Arkansas), on the IRS’s history of political bias, and the proposed bank reporting requirement:

“This is certainly not the route to go. It wasn’t too long ago that the IRS was targeting conservative groups. Now we’re seeing this situation where they’re going to be targeting the vast majority of the population. The idea of your financial transactions going to the IRS is wrong. That’s your business unless they have evidence you’ve done something wrong.”

Senator Joni Ernst (R-Iowa), on punishing hardworking Americans at the expense of far-left priorities:

“[This proposal] to weaponize the IRS--87,000 new IRS agents who will be snooping around in our bank accounts. Let’s be clear who’s going to be impacted--everyday Iowans, Iowa families, small business owners. [They] are already struggling to make ends meet under this Biden economy, and this is yet another harmful way Democrats are punishing hardworking Americans at the expense of their far-left priorities.”

Senator John Hoeven (R-North Dakota), on funding gimmicks, including the IRS proposal, in tax-and-spend bill:

“They want $80 billion to have a big IRS to go out and collect the big taxes in their big tax-and-spend bill. You have heard very clearly what that means for everyday Americans. Even with their $80 billion increase for the IRS and their big taxes, they don’t even begin to pay for their spending. They’ve got a bill with ten-years’ worth of taxes, and only a few years’ worth of programs. We all know those spending programs won’t stop after a few years. . . How about the timing? . . . More inflation. And what’s inflation? It’s a tax on everybody, and particularly a tax on low-income individuals.”

Senator John Cornyn (R-Texas), on fears the IRS will target, harass American taxpayers:

“Why would you trust this army the Democrats are calling for in their supersized IRS? We already know the abuses that have occurred in the past where conservatives in particular were targeted by the IRS. Then we see that confidential information, by law, is leaked routinely to the press. . . . People don’t have confidence that this new army of IRS agents the Biden Administration wants to hire will stay within its appropriate lane and collect taxes that are owed, but not target people who are maybe not of their political philosophy or orientation, or use the IRS to further harass and abuse the American taxpayer.”