Crapo Sheds Light on Reckless Spending and Job-Killing Tax Hikes

Tax hikes would hit workers and consumers hard, adding to the hardships they already face from runaway inflation

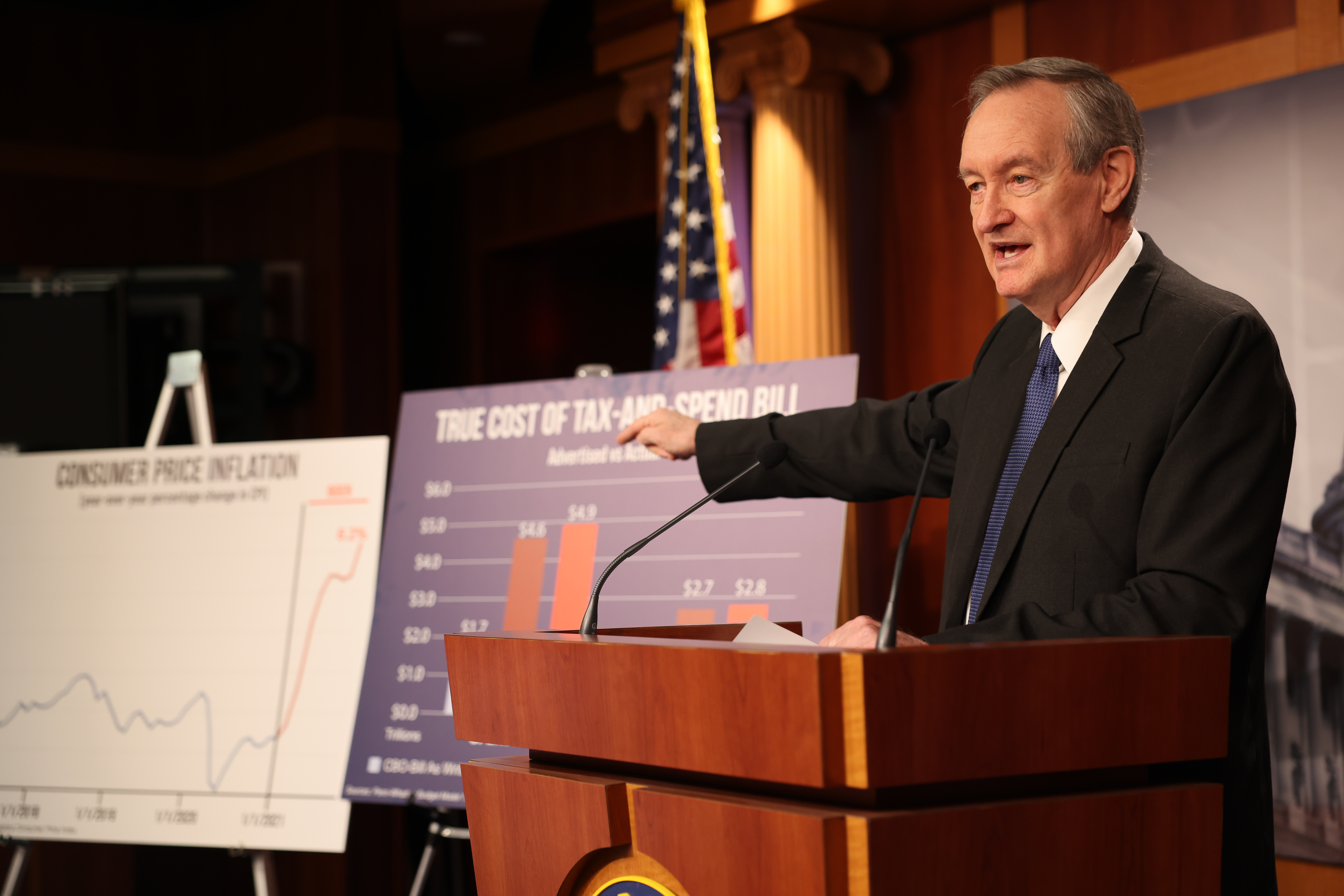

Washington, D.C.--U.S. Senator Mike Crapo (R-Idaho), Ranking Member of the Senate Finance Committee, today led a press conference with Republican members on the budgetary gimmicks and job-killing tax hikes in the Democrats’ reckless tax-and-spend legislation, which do nothing to address supply chain issues, nor inflation and rising consumer prices.

“[These proposals] do nothing to address rising consumer prices and supply chain issues, but would hit American manufacturers and make matters much worse,” said Crapo. “Tax hikes would hit workers and consumers hard, in addition to the record inflation they are already facing.”

On the true cost of the tax-and-spend legislation:

“The Democrats’ bill relies on a number of budget gimmicks in an attempt to hide the true cost of its misguided policies.

“There is no single year in which all tax provisions in the bill will be in full effect at the same time.

“And if you analyze the bill, based on the intentions of the bill, and run it out to a full ten years, Penn-Wharton comes out at a total cost of $4.6 trillion and the CRFB comes out at $4.9 trillion.

“They are several hundred trillion dollars apart, but both clearly show that the full cost of the bill, without gimmicks, is above four and a half trillion and approaching five trillion.”

On job-killing tax hikes:

“[These proposals] do nothing to address rising consumer prices and supply chain issues, but the taxes and revenue included in these proposals include more than $800 billion tax increases on American companies with supply chain issues and worker shortages.

“And study after study shows that these corporate taxes fall mostly on labor and capital; that’s on workers, jobs, salaries and benefits, and on investors, retirees, and pensioners.

“The Democrats’ book minimum tax would overwhelmingly hit American manufacturers, workers, and pensions.

“International tax increases would overwhelmingly hit American companies operating globally, not their foreign competitors, giving China, yet again, another advantage competitively.

“These tax hikes would hit workers and consumers hard, in addition to the record inflation they are already facing.”

Watch Crapo’s remarks here.

Watch the full press conference, including Q&A, here.