President Signs Crapo Banking Bill Into Law

Bill provides relief from burdensome red tape for Main Street borrowers and lenders

WASHINGTON – Community banks and credit unions across the country will soon receive regulatory relief from onerous regulations thanks to Idaho Senator Mike Crapo’s Economic Growth, Regulatory Relief and Consumer Protection Act (S. 2155), which was signed into law today. As Chairman of the Senate Banking Committee, Senator Crapo worked with his colleagues in the Senate, House, and outside groups and stakeholders to craft and usher this bipartisan banking legislation through Congress and to the President’s desk.

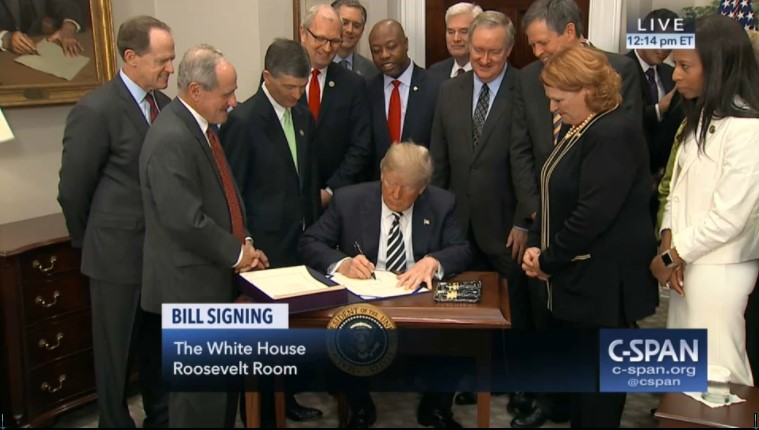

President Trump signs Crapo’s “Economic Growth, Regulatory Relief and Consumer Protection Act” into law. Click here or above for video.

“As Chairman of the Banking Committee, my priority has been to find agreement on commonsense reforms, particularly those targeted at improving economic growth,” said Crapo. “This bill’s passage marks one of our greatest achievements in the 115th Congress, but should not be unexpected. It is a bipartisan compromise, the changes are commonsense, and it will allow financial institutions to better serve their customers and communities, while maintaining safety and soundness and important consumer protections. At a time of intense political polarization, we have proven that we can work together to get things done for Main Street and the American people.”

“Passage of S. 2155 is a milestone that could not have happened without Sen. Crapo’s leadership, and Northwest credit union advocacy,” said Troy Stang, President and CEO of the Northwest Credit Union Association. “Congratulations to credit unions for their tenacity in making the case for this consumer-friendly legislation, and then working so hard to seeing it across the finish line.” He added, “Northwest credit unions have $1.3 billion invested in loans on 1-4 unit rental housing, which will now be available in the form of more loans. Think of the potential for that kind of capital infusion into local, small business loans,” Stang said.

“The passage of S. 2155 was a win for all constituents, families and businesses. A better economic future for Main Street begins with a pro-growth, bipartisan regulatory relief bill sent to the President’s desk to sign,” said Trent Wright, President and CEO of the Idaho Bankers Association. “The Idaho Bankers Association and our member banks say thank you to the leadership of Chairman Crapo and Chairman Hensarling for passing commonsense fixes to ill-fitting financial regulations that have limited the ability of banks to serve their communities.”

Background: For years, senators and members of the House on both sides of the aisle have been working to reach consensus on how to provide relief for smaller financial institutions from regulations that were meant for the biggest, most complex institutions, while also ensuring a safe financial system. The Economic Growth, Regulatory Relief and Consumer Protection Act right-sizes the regulatory system for smaller financial institutions, allowing community banks and credit unions to succeed and invest further in their local areas. Rather than spending time on compliance, these institutions can redirect resources toward what they do best – approving mortgages, providing credit, and lending to small businesses and families in their communities.

S. 2155 is the most significant piece of regulatory reform legislation for community financial institutions in nearly a decade. The Senate passed S. 2155 on March 14 with a strong, bipartisan vote of 67 to 31. The House subsequently passed the legislation, and it was signed into law by President Trump today. To learn more about the legislation, click here.

# # #