Senate Republicans Blast IRS Bank Reporting Dragnet

Finance and Banking Committee members highlight concerns with intrusive reporting scheme

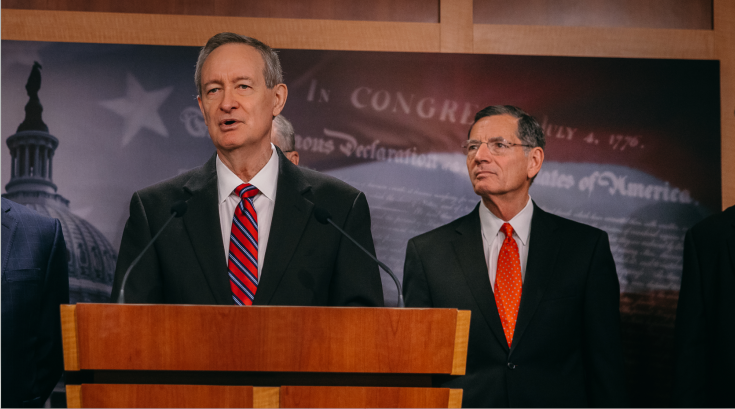

Washington, D.C.--U.S. Senator Mike Crapo (R-Idaho), Ranking Member of the Senate Finance Committee, and U.S. Senator Pat Toomey (R-Pennsylvania), Ranking Member of the Senate Banking Committee, today led a press conference with other Republican members of both committees to share concerns raised by their constituents about a proposal to create a reporting scheme where financial intermediaries report to the Internal Revenue Service (IRS) on customer deposits and withdrawals.

Highlights from the press conference:

Senator Mike Crapo (R-Idaho), Ranking Member of the Senate Finance Committee, on targeting those making less than $400,000 per year:

“The average American will be picked up by this plan. The proposal doesn’t just include banks and credit unions . . . The scope of the IRS’s ability to dive into these accounts will be the biggest violation of individual privacy that this country has ever seen . . . We asked the Joint Committee on Taxation to take a look at the distributional effect of this policy. JCT said if you look at the tax code and see where there is available money, it’s primarily in schedule C and schedule E. That picks up all small businesses, all individuals, everybody. [They analyzed] the tax gap and told us where it looks like the lost revenue is to be found. They found it was mostly in those making less than $500,000 . . . When you get to those making $500,000 or more, that only accounts for four to nine percent of expected recoveries from analyzing these schedules. If they are really not going to go after those who make less than $400,000, why don’t they just put a ban in there from snooping in the accounts of those making less than $400,000?”

Senator Pat Toomey (R-Pennsylvania), Ranking Member of the Senate Banking Committee, on the massive influx of data to the IRS:

“This is a breathtakingly terrible idea. We’re going to give all kinds of personal, private information about American citizens to the same IRS that famously discriminated against conservative organizations seeking a tax exempt charter; that very recently leaked massive amounts of completely private, personal tax information…This proposal will affect almost every single American. Not just the average American. The vast majority of Americans that will go through $600 per year. If they raise it to $10,000, it’ll still capture everybody and every small business. You have to ask yourself, ‘for what purpose?’ It tells you nothing about taxable income. That’s a complicated alternative set of rules. What will happen if they actually implement this? Americans will lose their privacy, private information will be provided about them, the IRS won’t know what to do with it… This is a terrible idea. It should never see the light of day.”

Senator Chuck Grassley (R-Iowa), on the threats of leaked private information:

“I hear from Iowans all the time they don’t want the peering eyes of the IRS snooping on them. The middle class will be hurt as a result of this, it won’t be the billionaires. This is a large-scaled fishing expedition that has no motive other than to make the private lives of individuals public to the IRS. Once it’s public to the IRS, as we have learned from ProPublica, they can’t even control their own information without getting all this information out to not be secure. The compliance costs are going to up the costs of banking for the middle class and small business America.”

Senator Jerry Moran (R-Kansas), on the compliance burden for small financial institutions:

“I spent most of the week last week in Kansas and this is the topic of conversation in almost every circumstance…Kansans will pay their fair share of taxes. They will pay what they are legally entitled to. But they do not expect, do not want the federal government to have more information….A banker in Paola tells me it’s not even law yet and he’s has customers closing their accounts. That’s a loss of business for those institutions. It also means the cost of complying means small institutions will have, once again, the burden of regulations, not less. A banker in Overbrook says this means further consolidation of smaller community banks as the cost of such a program would be impossible for such a bank to bear and thus, they would be forced to sell the bank…Make sure our financial institutions so important to the lives and wellbeing of Kansans and Americans don’t have one more burden they can’t afford to comply with.”

Senator John Thune (R-South Dakota), on the IRS’ history of keeping private information secret:

“This proposal would literally double the size of the IRS and allow them to snoop in every American’s bank transactions. This is something so sweeping--we have never seen anything like it before--where you are talking about an IRS dragnet across the bank accounts of every single American or at least every single American who banks. Even if it’s $10,000, this is going to capture millions of Americans…I have heard from thousands of South Dakotans already about this particular proposal…It will double the size of the IRS. The agency already has problems with keeping information secret. They have had huge leaks of massive amounts of volumes of individual private taxpayer information. If successful, who ends up paying for it? The Joint Committee on Taxation has said that about 75 percent of the revenue raised under this proposal would be generated by those making less than $100,000 per year…The burden of compliance is going to be borne by people in lower income categories.”

Senator John Barrasso (R-Wyoming), on doubling the IRS’ power:

“Joe Biden wants to increase the power of the IRS by $80 billion...Basically everyone will be caught in this dragnet. Why do they want to do this? Because they want to squeeze more dollars out of hardworking taxpayers in order to pay for their reckless $3.5 tax-and-spend proposal. It is the number one thing I heard about in Wyoming last week. It is the number one thing I’ve heard about in letters over the last couple of weeks. It’s an invasion of the privacy of the American people…The IRS is incapable of keeping their records private as they should be. The IRS does have a track record of targeting specific groups they don’t like politically.”

Senator Todd Young (R-Indiana), on historic, existing distrust of the IRS:

“At a time when the American people have lost so much trust in the leaders of our major institutions and of the institutions themselves, including government, I couldn’t think of a worse idea for national Democrats to embrace and put forward than their scheme in ensuring private information is provided to the IRS…Hoosiers remember the IRS--not many years ago--used political information, personal identifiable information to target people based on their political beliefs. It’s understandable people don’t trust the IRS. The IRS has been weaponized in other periods throughout American history. As a practical matter, the $600 threshold would sweep in even children with a moderately successful lemonade stand over a year. Even if the threshold were to be raised, that would still sweep in more than half of Hoosier households. This scheme isn’t workable. It is certainly not designed to build trust.”

Senator Tim Scott (R-South Carolina), on the burdens of the working class and unbanked Americans:

“I cannot understand how $600 transactions flows can help us find millionaires and billionaires cheating on their taxes. More importantly, there are 7 million Americans who are unbanked and maybe a little suspicious of the government. This proposal will keep those good Americans from being able engage and get involved with the financial systems of our country…puts burdens on working class Americans, hardworking paycheck-to-paycheck Americans who will now will have more to fear from the IRS…It sends shivers down the spine. For those Americans that are concerned government is too big, too onerous, too burdensome, this only adds more fuel to that fire.”

Senator John Kennedy (R-Louisiana), on the Democrats’ power grab:

“Whether it’s $600 or $10,000, under this proposal, the intimate financial details of everyone in this room, at a minimum of every American that has a job, will be turned over on a daily basis to the IRS…President Xi would be proud…Why throw the net so wide? This proposal, like a lot of proposals, in my Democratic friends’ bill is not about public policy and it’s not about taxes. It’s about control. There are too many people in charge right now in Washington, D.C., who just don’t trust Americans to know what is best for themselves. They just don’t’ trust Americans to make decisions for themselves.”

Senator Kevin Cramer (R-North Dakota), on the presumption of guilt:

“I have heard from thousands of North Dakotans--who bank--with great concern…They are frightened for very good reason. We are talking about some of the most private of information being shared--turning banks, tellers and credit unions into spies of the IRS. It sends shivers…This proposal is built on the premise that there are a bunch of guilty people. There’s a presumption of guilt. Why else would you need more agents to go after more people that buy a car?...Even if, for a moment, you want to buy into the notion there are a whole bunch of people not paying their fair share, this proposal doesn’t even accomplish what they claim to want to accomplish. It has always been about incremental steps toward socialism.”

###