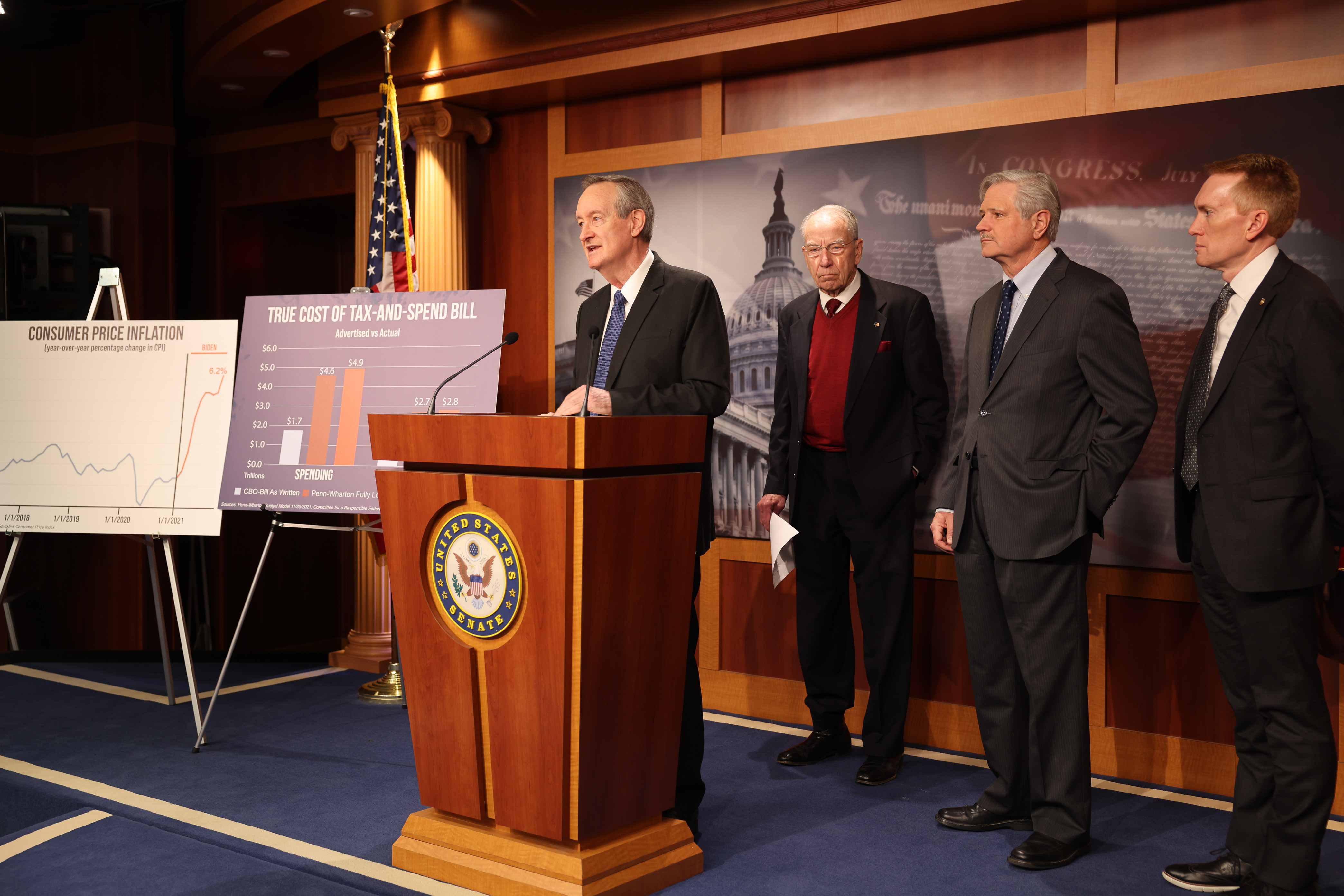

Senate Republicans: Reckless Tax-and-Spend Bill Will Make Bad Situation Worse

Washington, D.C.--U.S. Senator Mike Crapo (R-Idaho), the top Republican of the Senate Finance Committee, led a press conference with other Republican Senators on the budget gimmicks and job-killing tax hikes in the Democrats’ reckless tax-and-spend legislation, which do nothing to address supply chain issues, nor inflation or rising consumer prices. The senators noted that Democrats’ proposals would, in fact, make a bad situation worse.

Highlights from the press conference:

Senator Mike Crapo (Idaho), on the true cost of the tax-and-spend legislation:

“The Democrats’ bill relies on a number of budget gimmicks in an attempt to hide the true cost of its misguided policies. Studies from Penn Wharton and the Committee for a Responsible Federal Budget both clearly show that the full cost of the bill, without gimmicks, is above $4.5 trillion and approaching $5 trillion. . . . [These proposals] do nothing to address rising consumer prices and supply chain issues, but [they] include more than $800 billion tax increases on American companies with supply chain issues and worker shortages.”

Senator Chuck Grassley (Iowa), on the damage to small businesses:

“Main Street businesses are the lifeblood of our communities. They are also faced with a 6.2 percent inflation tax everybody is paying. These Biden tax increases are hitting small business, hurting our Main Street, hurting the backbones of our communities. Instead of helping small business, they are hurting small business. Instead of helping the middle class, they are hurting middle class. This is a blue-state billionaire bailout. Not something that ought to be helping the people it ought to help.”

Senator John Hoeven (North Dakota), on how more spending will drive further inflation:

“The inflation problem isn’t lessening, it’s getting worse. So, who does that hit the hardest? It hits low-income people the hardest. Think about seniors on a fixed income. When they go to the gas pump and are paying more than a $1 per gallon more than they did last year. Think about when you go to the grocery store—you know what that bill looks like. That inflation hits everybody, but hits low-income individuals and seniors on a fixed income the hardest. . . . This is absolutely the wrong way to go. . . . This is not what we need for our economy and our country. We need to get back to pro-growth policies that benefit all Americans.”

Senator James Lankford (Oklahoma), on tax hikes decreasing U.S. competitiveness:

“The continual tax policy tinkering discourages companies to invest, and will discourage companies from basing here in the United States. They are raising the rate for companies doing business internationally here in the United States. What they’re doing is saying, ‘We’re going to raise the rate here and every other country around the world promises in the future they will also raise their rate.’ . . . The [minimum book income tax] will hurt manufacturing businesses the most, [those] who have the opportunity to be able to write off new equipment and new expansion. Which means less purchasing of new equipment and less purchasing of new facilities and less expansion and less jobs. That’s exactly the wrong direction for us to go in this tax policy.”

Senator John Boozman (Arkansas), on the failure to address real concerns of the American people:

“This massive reckless spending bill has two problems. It’s bad policy with bad pay-fors. As I have traveled through Arkansas and throughout the country, I hear about inflation. Inflation on gasoline and food prices. I hear about the labor market, and how difficult it is. I hear about open borders. I hear about the supply chain. Instead of addressing the problems Americans are so concerned about, Democrats are doubling down with bad ideas and forcing Americans to pay for those bad ideas. . . . We are going to continue to press forward so that the American public realizes these things are totally out of step with their concerns, and all about radical policies the Administration would like to get done, with Americans footing the bill.”

Senator Rob Portman (Ohio), on tax cuts for the rich and hikes for the middle class:

“The people who are going to get benefits from this on the revenue side are the wealthiest Americans, and those who will be hurt are middle-income Americans and lower-income Americans. Whether it’s the spending side or the tax side, these are concerning problems. . . . When you increase taxes on companies, who takes a hit? Workers do in terms of wages and benefits. Seventy percent of the impact of these tax increases will be on workers. . . . My hope is that people will look at this and say, ‘This just doesn’t make sense at this time.’”